What is The Electric Car Scheme?

Switching to an electric car stands out as one of the most impactful ways to contribute positively towards achieving net zero. Our aim is to make this transition more cost-effective and straightforward than any alternative. The Electric Car Scheme facilitates this objective by enabling employees to achieve savings of 30-60% on any electric vehicle by opting to reduce their salary in exchange for an electric car as a benefit.

Browse our quote tool now to have a look at all the savings you can enjoy!

What is salary sacrifice?

Electric car salary sacrifice, backed by the UK government, offers a sustainable alternative to traditional petrol or diesel vehicles. This eco-friendly option enables you to make substantial savings on your journey towards a net-zero carbon footprint.

Unlike traditional car leases, where payments come from net pay (post-tax income), salary sacrifice deducts expenses from the gross salary (pre-tax income), thereby lowering your income tax and National Insurance (NI contribution) This tax-efficient approach enables employees to maximise their savings.

However, electric vehicles provided through The Electric Car Scheme fall into the ‘company cars’ category intended for personal use, rendering them liable to Benefit in Kind (BIK) tax. Presently, electric cars benefit from a favourable BIK rate of only 2%, applicable until 2025. Subsequently, this rate will gradually increase by only 1% each year until 2028.

BIK tax represents an additional taxable income for employees, subject to income tax. Typically, it is a percentage of the car’s list price, with varying percentages based on CO2 emissions and fuel type. This tax is then added to the employee’s total taxable income, potentially increasing their overall tax liability. Nevertheless, given how low this tax has been set, this represents a negligible impact on the cost of your lease.

Are you curious about the potential savings on your next electric car? Explore our EV salary sacrifice calculator here.

Why should you implement salary sacrifice?

As companies worldwide embrace the shift towards sustainable practices and corporate responsibility, implementing a salary sacrifice scheme for electric cars emerges as a strategic move with dual benefits: enhancing Environmental, Social, and Governance (ESG) initiatives and strengthening employee retention and recruitment efforts.

Positive ESG Impact:

By encouraging employees to opt for electric cars through a salary sacrifice programme, your organisation actively contributes to reducing carbon emissions. Electric vehicles are at the forefront of environmentally friendly transportation, aligning with global efforts to combat climate change.

The adoption of electric cars signifies a commitment to sustainable business practices. It showcases your company’s dedication to minimising its environmental footprint, a crucial aspect of ESG criteria that stakeholders, investors, and customers increasingly prioritise.

Strengthening Employee Retention and Recruitment:

Offering a salary sacrifice scheme for electric cars signals your commitment to employee well-being. Employees appreciate perks that enhance their quality of life, and contribute towards a sustainable future.

Furthermore, In a competitive job market, companies vying for top talent can gain a considerable edge by providing innovative benefits. A salary sacrifice scheme for electric cars not only demonstrates your commitment to sustainability but also positions your organisation as employee-centric.

Electric cars are becoming more affordable, and a salary sacrifice programme amplifies the financial advantages for employees. Saving on income tax and National Insurance contributions makes electric vehicles an attractive option, enhancing the overall compensation package for your workforce.

Why Choose The Electric Car Scheme?

Complete Risk Protection:

Salary sacrifice schemes for electric cars have gained recognition as the most cost-effective means of acquiring an electric vehicle. However, apprehensions persist among businesses regarding the expenses and practicalities associated with their implementation, with concerns about early termination fees being a key deterrent. For instance, if an employer needs to make an employee redundant, there is a potential risk of incurring a fee amounting to 50% of the remaining car lease costs.

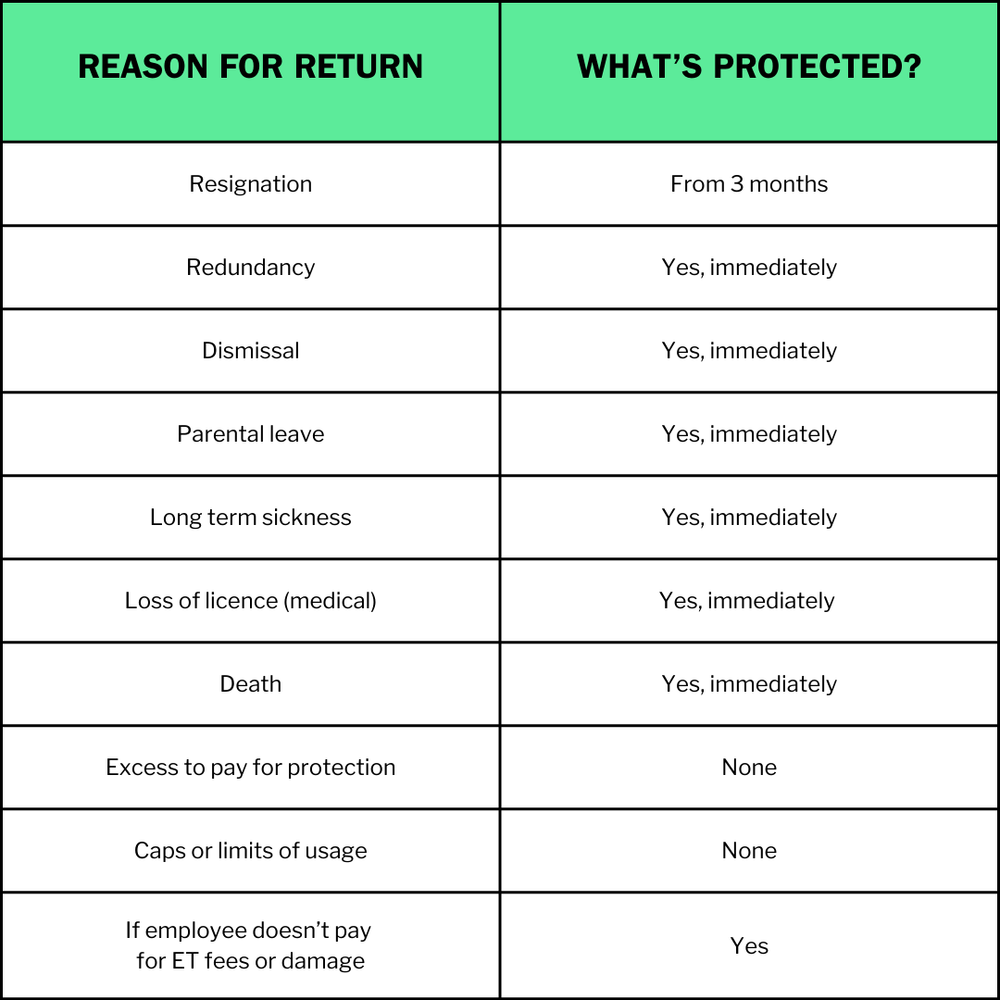

In the event that the car needs to be returned, our Complete Risk Protection can safeguard both the employer and the employee from unforeseen circumstances beyond their control.The new Complete Risk Protection package provides reassurance that the employer is protected from day 1. If an employer has to make redundancies or dismiss an employee, they can do this at any time without facing a fee.

This new proposition differs from other market offerings, which often feature complex terms & conditions, exclusion periods and return limits, potentially leaving employers with significant bills or headaches.

The Electric Car Scheme’s Complete Risk Protection package also protects the employer from any shortfall due to employee resignation, long term sickness, and family friendly leave. A new and unique feature even protects employers if the employee doesn’t repay the company for damage to their car.

No cost to the business:

The Electric Car Scheme is always net neutral for an employer. Our fee is equal to your tax savings on each lease and is calculated as the sum of the Employer National Insurance and the VAT amount reclaimable on the vehicle hire agreement and additional services or fees.

The Electric Car Scheme is committed to maximising employee savings, whilst offering employer’s the best risk protection and administrative support available on the market. In order to do so, we choose to not inflate lease prices or your employee’s gross salary sacrifice, thus, maximising their savings. In order to pay for the risk protection and support, we simply take our net neutral fee calculated from the NI and VAT savings the employer naturally sees.

Competitive pricing:

The Electric Car Scheme offers some of the most competitive pricing within the salary sacrifice space. The reason that we are able to offer such lucrative deals to the organisations that sign up with us is a consequence of both our strong relationship with car manufacturers, as well as our ability to remain flexible within the leasing market by employing a panel of the UK’s biggest funders and being able to select the most advantageous deals for your employees.

You can make a positive change towards net zero by switching to an electric car, and what better time than now?

Book a call with one of our specialists today!